Debt consolidation interest rates are crucial when merging loans for better terms. Lower rates reduce repayment costs, affected by credit score and debt amount. Compare consolidation with debt settlement, understanding factors for informed decisions. Consolidation streamlines repayment, saves money on fees, and enhances expense tracking. Choose a consolidator with affordable rates and strategically time consolidation for maximum savings. Avoid hidden costs by considering loan terms, fees, and consolidator reputation for responsible long-term management.

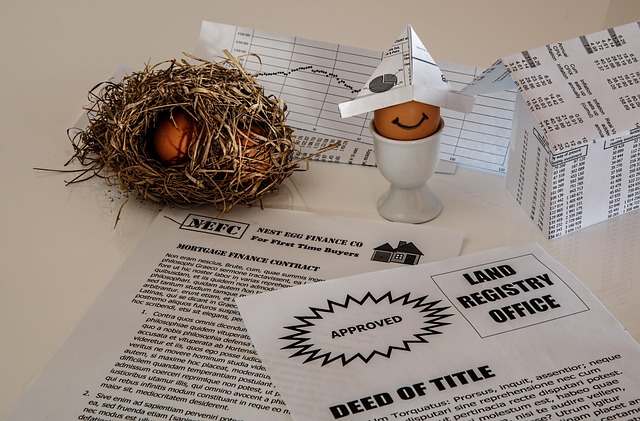

Struggling with multiple debts and high-interest rates? Lower your debt interest with a consolidation solution—a strategic move towards financial freedom. This article guides you through understanding debt consolidation interest rates, exploring the numerous benefits of reducing debt interest, and navigating diverse consolidation options tailored to your needs. Discover how consolidating your debts can simplify repayment and save you significant money in the process.

- Understanding Debt Consolidation Interest Rates

- Benefits of Lowering Debt Interest

- Navigating Debt Consolidation Options

Understanding Debt Consolidation Interest Rates

Debt consolidation interest rates are a crucial aspect to understand before taking this financial step. When you consolidate your debts, you’re essentially combining multiple loans into one with a single set of terms and conditions. The key to saving on interests lies in securing a lower interest rate on the new loan, which will then be used to pay off your existing debts. This process can significantly reduce the overall cost of repayment compared to managing multiple high-interest debts separately.

Several factors influence debt consolidation rates, including your credit score, the amount you owe, and the type of consolidation option chosen. Lenders consider these elements to determine the risk associated with lending to you. A strong credit history often leads to more favorable rates as it signifies a lower risk for lenders. Moreover, comparing debt consolidation vs. debt settlement is essential. While consolidation focuses on lowering interest rates and simplifying repayment terms, debt settlement involves negotiating with creditors to accept less than the total amount owed, which could have tax implications and impact your credit score. Understanding these aspects helps in making an informed decision regarding managing your debts effectively.

Benefits of Lowering Debt Interest

Lowering your debt interest through debt consolidation offers numerous benefits. Firstly, it simplifies repayment by combining multiple debts into a single loan with a fixed interest rate, eliminating the hassle of managing several payments. This streamlining not only reduces stress but also helps in tracking expenses more effectively. Secondly, debt consolidation allows for significant savings on interest fees over time, as the new loan is structured to have a lower overall interest rate than the sum of your existing debts’ rates.

Selecting a consolidator with affordable rates is crucial, and understanding the optimal timing for debt consolidation can further enhance these savings. Timing your consolidation strategically, such as when interest rates are low or during periods of financial stability, can lead to substantial reductions in the overall cost of your debt. Additionally, negotiating with lenders or exploring various debt consolidation strategies can help lower your debt consolidation loan rates even further, ultimately allowing you to pay off your debt faster and more affordably.

Navigating Debt Consolidation Options

Navigating Debt Consolidation Options can seem daunting given the plethora of choices and variable interest rates available in the market. The first step is to understand that debt consolidation isn’t just about lowering your debt; it’s also about securing favorable debt consolidation interest rates. These rates significantly impact how quickly you pay off your debt and the overall cost. While it might be tempting to opt for the lowest rate, it’s crucial to consider other factors like loan terms, fees, and the reputation of the consolidator.

An urgent debt relief strategy often involves finding a debt consolidator offering lowest rates. However, it’s wise to stop and consider whether such low rates come with stringent conditions or hidden costs. To avoid debt consolidation rate hikes, thoroughly research and compare multiple offers. Reputable consolidators should be transparent about their terms, ensuring you have a clear understanding of your financial obligations before agreeing to any plan. Remember, the goal is not just to drop debt consolidation rates but also to manage them effectively for long-term financial stability.

Debt consolidation offers a strategic approach to managing high-interest debt. By understanding the factors influencing debt consolidation interest rates and exploring available options, individuals can gain control of their finances. Lowering debt interest through consolidation not only simplifies repayment but also saves money in the long run. It’s a powerful tool for navigating financial challenges and achieving a more secure financial future.